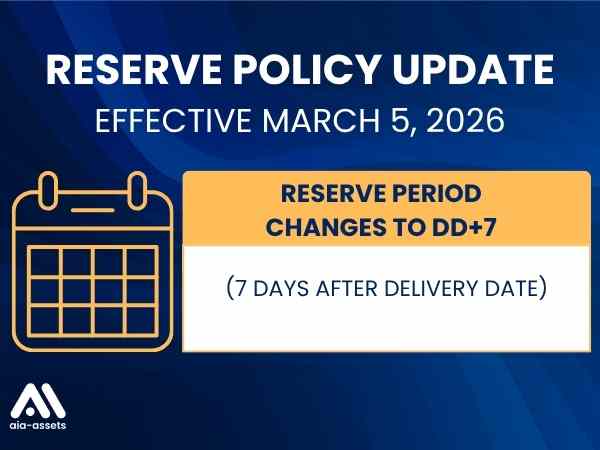

For years, “aged premium” seller accounts on Amazon often enjoyed more favorable terms — faster disbursements, fewer restrictions, and generally smoother cash flow. But now Amazon is moving toward a standard reserve policy across virtually all 3P sellers: a hold on the funds until seven calendar days after the confirmed delivery date (i.e., “DD+7”) before funds become eligible for disbursement.

Why Amazon is doing this?

From Amazon’s vantage point the logic is fairly clear:

They’re looking to buffer against returns, customer claims, refunds and chargebacks.

They want delivery to be confirmed and allow a short “evaluation window” for buyers to open/discover issues before paying the seller.

They are standardizing payout terms globally, reducing special-cases or aging accounts having better terms. It levels the playing field (for Amazon) and presumably reduces their risk or complexity.

Cash flow impact

Prior to this, many sellers could rely on payouts relatively soon after shipment or delivery and hence reinvest in inventory, ad spend, restocking, supplier payment. Under DD+7, that timeline is extended. Things that were predictable become more stretched.

For sellers operating with thin margins, or heavy restocking/lead-time cycles, seven extra days (or more, when you include shipping delays etc) can cause real strain.

Accounting & reporting headaches

Because Amazon now holds “deferred transactions” (sales for which Amazon hasn’t yet released funds) the revenue, fees, cost of goods sold (COGS) and bank settlement timing get misaligned.

Operational implications

If you have long shipping or delivery lead times, the delay compounds: you shipped early → delivered late → +7 days → funds released.

Untracked or low-value shipments (where delivery confirmation is delayed) can cause uncertainty about when Amazon will consider the “delivery date” for the DD+7 countdown.

In transition (migration) phase, Amazon itself warns of “a one-time cash flow impact … temporarily limit your ability to disburse funds on or around your migration date.”

Psychological / strategic dimension

This change is a reminder: in the Amazon ecosystem the rules can shift. Today’s “premium age” advantage might vanish tomorrow. Sellers who rely on smooth, fast payouts are exposed when the infrastructure changes. It underscores the need for operational resilience, diversification of channels, and robust planning.

The opportunity: (because yes, there is one)

Let’s pivot from “this is a burden” to “how can we make this work and maybe turn it into an advantage”.

1. Cash-reserve discipline & buffer building

Now is the time to review your cash reserves. If you were working on a minimal buffer before, you may need to build a 7-day (or more) buffer. Consider the size of your average weekly Amazon payout and aim to have at least that in liquid cash.

One way to think: If your weekly Amazon sales are $50k, then under DD+7 that $50k is effectively credit to Amazon for an extra week. Build your working capital accordingly.

2. Lead-time optimization & shipping strategy

Shorten the time between shipment and delivery — the faster your items reach customers, the earlier the “delivery date” for DD+7 triggers. For FBM sellers, this means carrier selection, tracking, faster prep. For FBA sellers, favorable.

Minimize untracked shipments, or shipments with ambiguous delivery scans: uncertainty delays the countdown. Also, think about geographic distribution of inventory so delivery times shrink.

3. Inventory & restocking strategy

Because payouts are delayed, you may need to shift inventory planning: pre-stock more safely ahead of restock lead times rather than relying on fast cash turnover.

Monitor fast‐moving SKUs and ensure you have cushion, so delayed funds don’t force you to miss restocking and lose momentum or Buy Box visibility.

4. Advertising & promotion alignment

Avoid heavy bursts of ad spend or promotional campaigns unless you’re confident in your reserves, because the cash to fund ads might arrive later than you expect.

Alternatively, use the delay proactively: if you know you won’t see funds for a week, align your promotions accordingly (e.g., ramp up after you know funds will be available).

5. Accounting & KPI recalibration

Align your accounting and revenue recognition assumptions with the new timing. If you previously recognized revenue at shipment or delivery, now you’ll recognize at “delivery + 7 days” (or at least, you need to adjust your internal dashboards).

6. Channel diversification & risk mitigation

One of the take-aways: Amazon controls a lot of the rules. When they change, the impact lands on sellers. Use this as a reminder to build off-Amazon sales channels, diversify marketplaces, build your own DTC (direct-to-consumer) presence.

If you’re too dependent on Amazon’s cash-flow pipeline, a policy shift like DD+7 can amplify risk.

What to do now

Review your current payout pipeline: check how many orders are in “delivered but not yet 7 days” state, estimate the cash currently on hold.

Build a “what-if” scenario: if your payout gets delayed another 7-10 days (because of shipping delays, delivery scans, claims) what is the worst-case hit to working capital?

Adjust your forecast for Q4 (or your busy period) accordingly: assume slower cash access, and plan your procurement/ad spend accordingly.

Talk with your bank/financing partner: if you use factoring, credit lines, or inventory financing, let them know of the shift in Amazon payout timing so you are not caught off-guard.

Audit your shipping/tracking performance: ensure delivery scans happen promptly, reduce “in transit” duration, reduce reliance on untracked shipments.

Monitor your accounting/tax reporting compliance: ensure your finance team understands the difference between settlement date, disbursement date, and revenue recognition date.

Prepare a communication/strategy for your team: restocking, advertising, supplier payment schedules may need adjustment. Having the team aligned early makes the transition smoother.

Final thoughts

Sellers who treat this as a moment to upgrade operational discipline, fortify working capital, and sharpen their logistics and accounting core will come out stronger.

In fact, this might be less about Amazon being “mean” and more about the marketplace entering a new phase: one where resilience and systems matter even more than speed. The fastest turnaround isn’t always the best if you’re constantly chasing short-term liquidity.

So: take this change seriously. Review your numbers, adjust your processes, communicate clearly with your team and suppliers. Then lean into the future-proofing of your business. Because in a more balanced marketplace, the sellers who adapt will thrive.

Let’s talk more about this! Please reach out to our team Aharon@Aia-assets.com to learn more!